Why Choose Easi for Your QLD Gov Novated Lease?

When considering a novated lease for your next motor vehicle, the benefits extend beyond simply acquiring a car; it’s about making a financially savvy decision that aligns with your lifestyle and budget. Here’s why Easi is a great choice for Queensland Government employees:

Unmatched Expertise in Government Leasing

Easi is not just proficient in novated leasing; we possess specialised knowledge in managing novated leases for a range of Government employees. This expertise ensures that your lease is structured to harness all potential tax savings available through your employment.

The Easi team are experienced Queensland locals and respond to enquiries within 3 hours ensuring you have the information you need in a timely manner.

Based on Your Needs

Before you enter into a novated lease, we ensure you are fully informed about how your salary deductions will be structured for both the lease payments and the vehicle’s running costs. This proactive approach empowers you to make an informed decision tailored to your specific situation.

We do recommend that employees seek independent financial advice before commencing a novated lease.

Maximising Potential Tax Savings

One of the most significant advantages of a novated lease is the potential tax savings it offers. Easi’s expertise working with Government employees means we’re adept at structuring your novated lease to maximise these savings.

Our team works diligently to ensure that every aspect of your lease, from the vehicle selection to the salary deductions, is optimised for tax efficiency.

Tailored Salary Deductions

Understanding the intricacies of salary deductions is key to a beneficial novated lease arrangement. At Easi, we tailor your salary deductions to align with your budget and financial goals, ensuring that your lease structure is both affordable and tax-effective.

Prior to entering into any agreement, we provide a clear, detailed breakdown of how your salary deductions will be applied, giving you complete transparency and peace of mind.

Comprehensive Support and Guidance

Choosing Easi means you’ll benefit from our end-to-end support throughout the entire process of your novated lease. From the initial consultation to finalising the lease and beyond, our team is here to offer guidance, answer any questions, and ensure your novated leasing experience is smooth and beneficial.

Whether it’s assistance in selecting the right motor vehicle or explaining the finer details of your lease agreement, our advice is always tailored to your unique needs. As always, we strongly recommend you seek independent financial advice before entering into a Novated Lease agreement.

With a 4.9 star customer rating, the easi team aims to ensure you are looked after throughout your lease term. With a dedicated support hub available 24/7 you will have all your lease details accessible when you need it.

The convenience of the single easi fuel card for all service stations is a feature our current QLD customers love, along with the quick online reimbursement feature for those servos off the beaten track!

How a Queensland Government Novated Lease Works

If a novated lease package sounds good for your own particular circumstances, Easi are able to get a novated lease sorted for you in a straightforward process. Here’s our 5 steps to your next car:

- Enquire

- Quote & Consultation

- Online Application

- Order The Car

- Online Sign Off & Delivery

You Could Save More as a Queensland Government Employee with Easi

For Queensland Government employees, a novated lease with Easi presents an excellent opportunity to achieve tax efficiency, budgeting ease, and the joy of driving a car suited to your lifestyle.

Easi’s expertise in government salary packaging and novated leasing ensures that you have a positive experience from initial quote, right through to your everyday servicing needs.

Ready to explore how a novated lease could benefit you? Contact Easi to discuss your options with one of our friendly novated leasing specialists and take the first step towards smarter vehicle ownership.

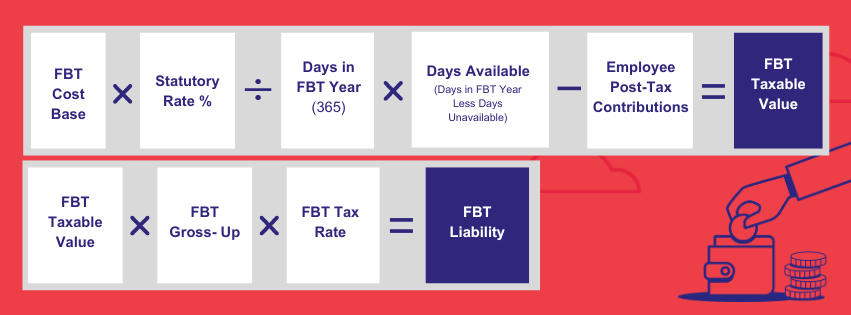

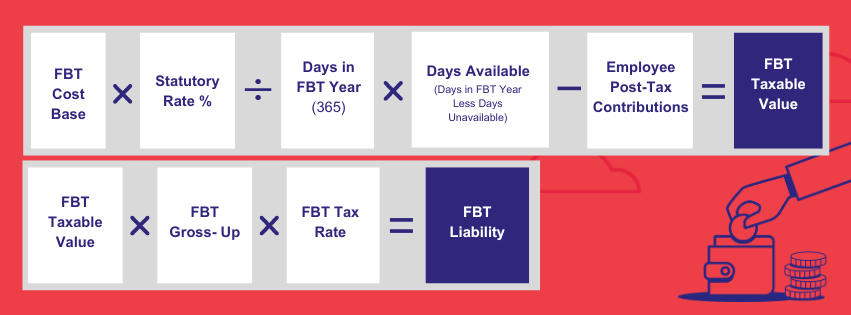

Guidelines for FBT liability calculation